Would it be the right time to refinance your residence mortgage? Home loan refinancing implies taking a fresh mortgage through the same lender or another loan provider on additional beneficial terms in order to pay-off the existing loan or even have an added amount borrowed as a top-up.

How it operates: “The borrower has to send your home application for the loan to another lender for any approval process for the mortgage refinancing,” states V. Swaminathan, President, Andromeda and Apnapaisa. The other lender first verifies the mortgage contract information, requests essential records and then gets last affirmation for exchange on the mortgage.

Why don’t we see the causes you might want to refinance a mortgage and what you must understand.

To avail a lowered rate of interest: “Reducing their interest rate could lower interest outflow, your own tenure and invite for much more savings,” says Gaurav Mohta, main marketing officer, HomeFirst loans. You should just agree to refinancing at the beginning of your loan period since that’s the energy where the majority of your EMI payments are caused by interest outflow. “You should best start thinking about refinancing if you’re getting a RoI (interest) reduced amount of 3% or more. Normally, for a loan of ? 50 lakh or reduced, the purchase cost are rather highest also it won’t mathematically make sense. Thumb rule – break down your transaction cost in monthly instalments and see if you can breakeven in 6 months,” he adds.

Change from repaired to floating speed and the other way around: “Sometimes, as soon as you choose a set interest, you eventually be sorry because interest levels beginning slipping. When this happens, changing to a floating interest is the sensible action to take,” says Mohta.

However in some cases, it might make sense to move to a hard and fast speed. “If the loan are used while in the festive season give, the attention costs recharged will be the lowest, and thus it’s a good idea to pick fixed interest rates as the rates are surely likely to escalation in the long run,” claims Swaminathan.

To improve/ reduce the mortgage tenure: “By reducing the tenure amount, the debtor could become debt-free early. Decreasing the loan amount can help the debtor save the mortgage payment levels, calculated on a cumulative or state, compounded annual factor,” states Swaminathan. It is possible to opt to raise your mortgage tenure if you want lower EMIs.

You might also wish to refinance your residence mortgage to obtain a top-up mortgage from the brand-new loan provider or because you commonly pleased with the help of your existing loan provider.

“Before refinancing, you need to learn the total interest which will be protected from the outdated mortgage (A) therefore the interest payable in the future about new loan (B). A-B may be the full levels you have spared for the period together with your loan,” says Abhishikta Munjal, main risk policeman at IIFL homes financing Ltd.

Remember there would be further bills for example handling charge, document verification costs etc.

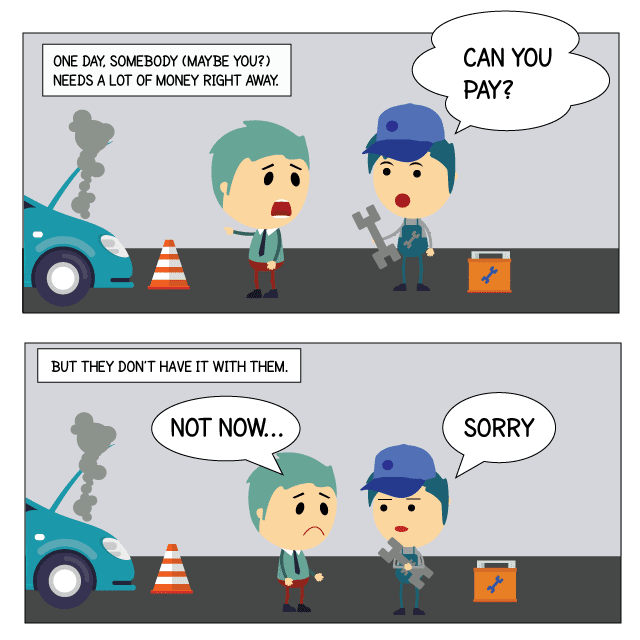

If you have several loan options, looking for the most effective and least expensive financing is stressful, and there are many different facets you’ll need give consideration to. With different financing terms, opportunity restrictions and monthly premiums, finding the optimum offer can take some perform. There are a few basic facts to consider and review before choosing an ideal financing for you.

Loan label in years

Evaluate the various mortgage words, as soon as feasible, pick the shortest financing phase accessible to you. While a less mortgage phrase will more than likely enhance your monthly premiums, you can use yourself spending a lower quantity of total interest.

If for whatever reason, the shorter mortgage phrase boasts a greater portion rates, then you can start thinking about using long-term financing but creating larger costs, assuming that there isn’t a prepayment punishment.

Interest rate/Annual percentage rates (APR)

The interest rate and/or annual percentage rate (APR) is one of the most critical indicators to take into consideration when ensuring which loan is perfect. For a few loan sort, evaluating interest rates is suitable, however the APR is actually a far better number to examine. The APR points in costs, like points and origination fees, although the interest is only the standard interest recharged. For mortgage loans, lenders must let you know the APR, and comparing the APRs are a better way to correctly decide which loan costs more eventually. However, for changeable rate loans, there’s no smart way evaluate interest levels. Typically, the comparison relates to regardless if you are more comfortable with the variability in interest on top of the loan name, also the recent payment.

Balloon money

Some financial loans have actually a loan term this is certainly smaller as compared to amortization label. Those loans normally need a balloon repayment because of that will be simply the continuing to be bad debts at the conclusion of the mortgage name. If you should be examining that loan with a balloon fees versus one that doesn’t, remember that you will need to have actually that cash offered to shell out if it becomes because of, or you’ll need certainly to refinance.

Overall balance due

The total amount had includes the initial levels lent plus interest and fees.  You will need to pick the loan because of the minimum sum of money owed on the entire phase, whenever you pay the monthly installments.

You will need to pick the loan because of the minimum sum of money owed on the entire phase, whenever you pay the monthly installments.

Payment

At long last, glance at the monthly payments to see extent you’ll should pay every month. Even though some loans with adjustable interest rates or balloon repayments may possibly provide a diminished payment per month than many other debts, be certain that you’re not getting in over your mind. If you are stretching yourself financially with an interest-only repayment and other sort of reduced payment per month loan, re-evaluate precisely what you really can afford. Overall, make financing using the cheapest interest rate/APR and loan phrase providing you are able the payment.

Gửi đánh giá